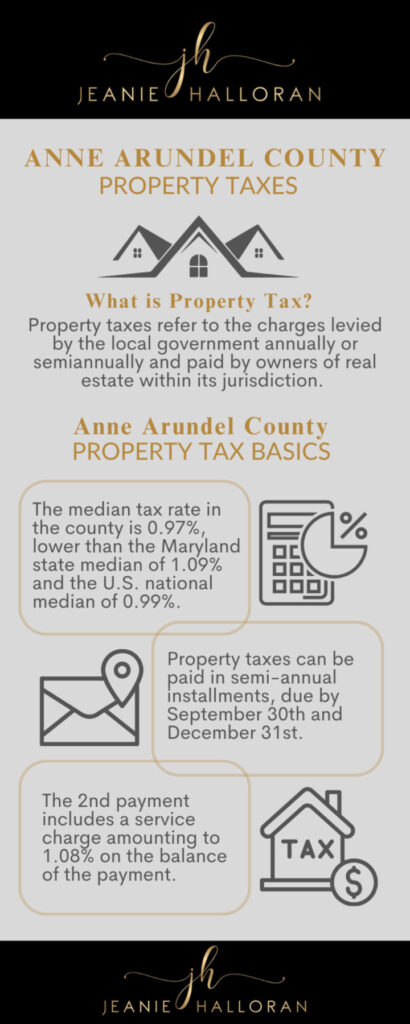

Property taxes refer to the charges levied by the local government annually or semiannually and paid by owners of real estate within its jurisdiction.

In Anne Arundel County, property tax plays a crucial role in funding essential local services, such as public schools, road maintenance, and emergency services.

Understanding Property Taxes

Property tax is assessed on an individual’s:

- Primary residence

- Second home

- Rental property

- Other real estate, such as commercial property

Anne Arundel County Property Tax Basics

When you perform an Anne Arundel County property tax search, one of the search results will show you the median tax rate in the county, which is 0.97%. This is lower than the Maryland state median of 1.09% and slightly below the U.S. national median of 0.99%.

Anne Arundel County issues real property tax bills for properties located within its jurisdiction. This is based on the assessment, ownership, and property description information provided to the Office of Finance by the Maryland Department of Assessments and Taxation.

Property Tax Assessment

The Anne Arundel County Property Appraiser is responsible for determining the taxable value of each piece of real estate. This information is used by the Tax Assessor, who is responsible for setting property tax rates.

The Tax Collector is responsible for the collection of property tax from real estate owners. They issue yearly tax bills to all property owners in Anne Arundel County. They also coordinate with the sheriff’s office regarding the foreclosure of properties with delinquent taxes.

If you have any questions or concerns on matters listed below, contact the Anne Arundel County Assessor:

- The due date for the payment of property tax

- How to pay your property tax

- Your property tax bill

- Information on your property’s tax assessment

- Appealing your property tax appraisal

- Reporting upgrades or improvements

The Assessor’s Office is located in Annapolis, the county seat of Anne Arundel County.

Payment Process

Real property taxes on a homeowner’s principal residence can be payable in semi-annual installments:

- 1st installment: due by September 30th

- 2nd installment: due by December 31st

The second payment includes a service charge amounting to 1.08% on the balance of the payment. This can be avoided by paying the full annual amount by September 30th.

Taxpayers who escrow their tax payments may opt to pay annually, but they need to inform their lenders by May 1st of their intent to pay annually.

If you are paying with cash or check, you may send your payment to the following cashier locations:

- The Arundel Center, 44 Calvert Street, Annapolis

- Heritage Office Park 2664 Riva Road, Annapolis

- The Arundel Center North 101 North Crain Highway, Glen Burnie

Credit card and eCheck payments are accepted only through Anne Arundel County’s website.

Exemptions and Credits

Tax credits affect how much you will pay for your property tax bill. In Anne Arundel County, several local property tax credits have been enacted for the benefit of the owners of real property located within its jurisdiction, reducing the liability for county property taxes.

Under the Maryland Homeowners’ Property Tax Credit Program, credits are granted to eligible homeowners with a combined gross household income below $60,000.

The Maryland Homestead Tax Credit Program was established to help homeowners by limiting the increase in taxable assessments each year to a fixed percentage. In Anne Arundel County, the established limit is 2%.

Anne Arundel County also offers optional property tax credits for the following:

- 9-1-1 specialists

- Agricultural land

- Airport noise zone

- Commercial revitalization area

- Conservation land

- Disabled or fallen law enforcement officers and rescue workers

- Disabled veterans and their surviving spouses

- Geothermal energy

- High-performance dwellings

- Historic preservation

- Public safety officers

- Religious organizations

- Residential rehabilitation

- Retired veterans

- Solar energy

- Stormwater management and erosion control

Appealing Property Tax Assessments

Property owners who believe that the assessed value is too high and does not accurately reflect the current market value of their property may initiate a property tax appeal. The appeal process allows property owners the opportunity to dispute the value determined by the Property Appraiser.

A property tax appeal typically involves submitting an appeal application, providing supporting evidence from local housing data, and attending a hearing to present your case. Local authorities will then review your case to determine if your appeal is justified.

A citizen first appeals his property tax assessment to the Maryland Department of Assessments, then to the Property Tax Assessment Appeals Board, and then to Tax Court.

Property tax appeals may be filed on three occasions:

- Upon receipt of an assessment notice

- By a petition for review

- Upon purchase of property between January 1 and June 30

There are four options for an appeal:

- Written appeal

- Phone hearing

- Video hearing

- In-person hearing

Comparing Property Taxes Across Maryland

Anne Arundel County’s average effective property tax rate is relatively lower than that of other counties, at 0.97%. However, since home values in the county are high, annual property tax payments for many homeowners are high, too.

The median property tax payment in Anne Arundel County is $3,594 per year, $799 higher than the national average.

Below is a table showing the average effective property tax rates in other counties in Maryland:

| County | Average Effective Property Tax Rate |

|---|---|

| Howard County | 1.37% |

| Baltimore County | 1.26% |

| Frederick County | 1.18% |

| Charles County | 1.14% |

| Carroll County | 1.07% |

| Harford County | 1.02% |

| Montgomery County | 0.99% |

| Prince George’s County | 0.99% |

Conclusion

There you have it – your quick guide to Anne Arundel County’s property taxes. If you’re a first-time homeowner, it is important that you set aside a budget for this additional expense after your home purchase.

If you have any questions about this topic or if you are interested in buying a home in Anne Arundel County, you may contact me at 443-360-7111 or jeaniehalloran@gmail.com.

Frequently Asked Questions

What is the current property tax rate in Anne Arundel County?

Anne Arundel County’s average effective property tax rate is 0.97%.

How are property taxes assessed?

The Anne Arundel County Property Appraiser determines the taxable value of each piece of real estate in the county. This information is used by the Tax Assessor for setting property tax rates.

Are there payment plans available?

Real property taxes on a homeowner’s’ principal residence can be payable in semi-annual installments. The 1st installment is due by September 30th and the 2nd installment is due by December 31st.

How do I appeal a tax assessment?

A property tax appeal typically involves submitting an appeal application, providing supporting evidence from local housing data, and attending a hearing to present your case.