Anne Arundel County, the heart of Maryland, is a beautiful place to call home with its rich history, a scenic shoreline with breathtaking waterfront, and gorgeous luxury homes.

When buying a home in Anne Arundel County, it’s important to have a clear understanding of all the expenses involved with purchasing a property, such as the closing costs. This will ensure that you set realistic financial goals, make informed decisions, and have the necessary funds.

This article provides relevant information on Anne Arundel County closing costs for both buyers and sellers, to help you prepare for this major milestone.

What Are Closing Costs?

Closing costs, also called settlement costs, are a sum of fees and charges that must be paid to different stakeholders to finalize the real estate deal and transfer ownership of the house. These costs are paid in addition to the net property amount.

In Maryland, both the buyer and seller pay certain closing costs at the end of the real estate transaction. Depending upon the conditions of the Anne Arundel County real estate market, the buyer or the seller can negotiate their share of the closing costs.

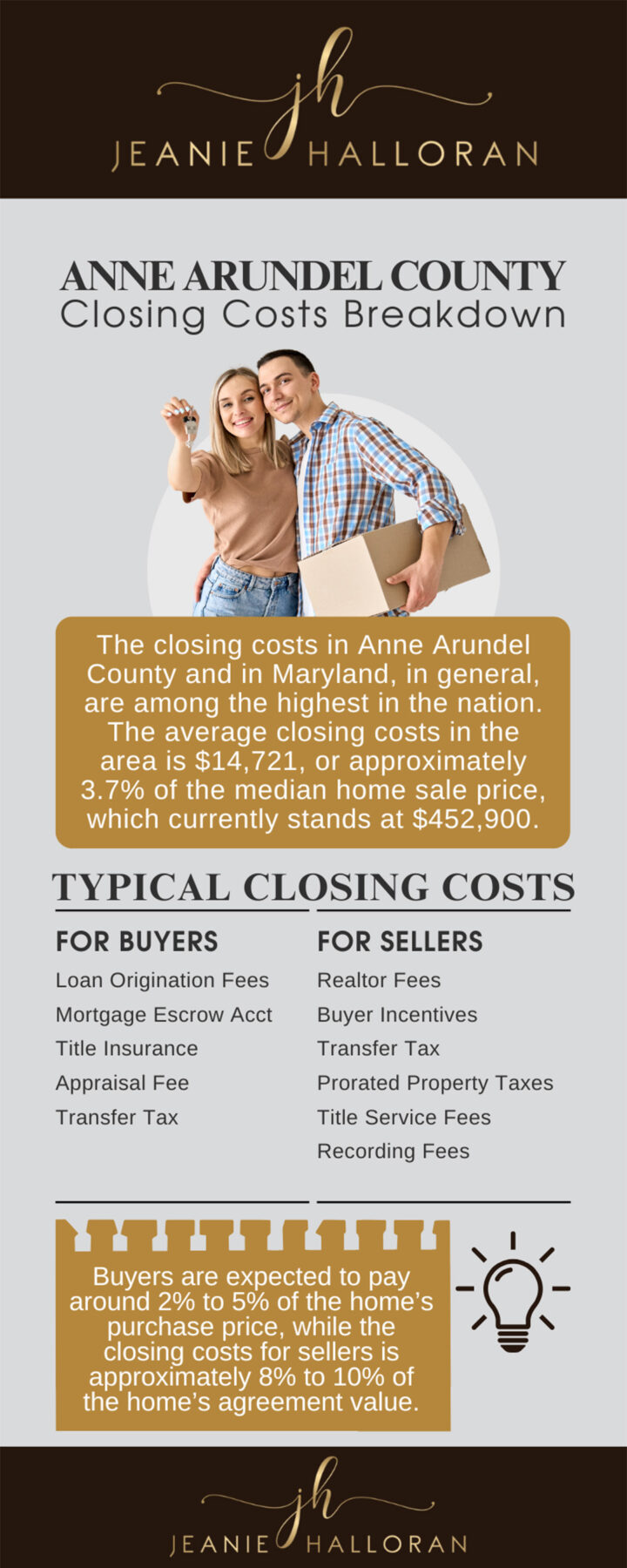

Anne Arundel County settlement costs (and in Maryland, in general) are among the highest in the nation. The average closing costs in the area is $14,721, or approximately 3.7% of the median home sale price, which currently stands at $452,900.

Closing costs can include fees for loan origination, title insurance, home inspections, and other services. It’s crucial for the buyer to account for these expenses when planning a home purchase to ensure you’re financially prepared.

The percentage may seem small, but this can add up quickly on higher-priced homes, resulting in a significant out-of-pocket expense for the buyer.

Anne Arundel County Property Transfer Taxes and Recordation

Property transfer taxes are charged by state or local governments when ownership is transferred from the seller to the buyer. These taxes are due when the title of a property is officially transferred to the new homeowner.

In Anne Arundel County, both the buyer and the seller are responsible for transfer taxes. Typically, the buyer and the seller split these costs, which are negotiated as part of the sales agreement.

Anne Arundel County property transfer taxes are set at 1% for transactions under $1 million, and 1.5% for those at $1 million or more. Anne Arundel County also charges a recordation tax, levied at a rate of $7.00 per $1,000 of the property’s sales price.

Buyer's Closing Costs

Buyers are expected to pay around 2% to 5% of the home’s purchase price on the Anne Arundel County real estate settlement.

-

Loan Origination Fees

A loan origination fee is charged by mortgage lenders to execute the loan with other respective documentation and legal formalities. This fee usually amounts to 1% of the mortgage loan amount. -

Mortgage Escrow Account/ Impound Account

A portion of the buyer’s monthly mortgage payments is reserved in an escrow or impound account and maintained to pay the property tax and homeowners' insurance premiums. This is managed by a mortgage servicer, who makes the payments on behalf of the buyer. -

Title Insurance

The title insurance protects against any type of loss with respect to outstanding taxes, unpaid dues, default in the title, or violations. In Maryland, this could cost around $200 to $250. -

Appraisal Fee

Appraisal fees are paid to the professional appraiser who assesses the home value and ensures that the buyer gets the best competitive price. In Maryland, this fee ranges from $300 to $500.

Seller's Closing Costs

The closing costs in Maryland for sellers is approximately 8% to 10% of the home’s agreement value.

-

Realtor Fees

The seller and the buyer both sign a contract with their own agents, promising to pay the realtor fees once the property is sold. The average listing agent fee in Maryland is 2.74%, and the average buyer's agent fee is 2.39% of the home's sale price.

Many sellers offer to pay for the buyer's agent out of the home sale proceeds, as this can help secure a deal. This totals to 5.13% of the home's sale price. -

Buyer Incentives

In tough markets, offering buyer incentives can help the seller secure the sale of the property. This can include some or all of the buyer's closing costs, repair credits, or valuable items in the sale of the home. -

Transfer Tax

In Maryland, the transfer tax is usually shared equally by the buyer and the seller. The transfer tax rate is 1%, so each would shoulder 0.5% of the home's sale price. -

Prorated Property Taxes

When a home is sold, the seller still has to pay property taxes for the months that they still owned the property. In Anne Arundel County, the property tax rate is 0.95% of the assessed value. -

Title Service Fees

Title fees cover the costs of the title search and title transfer. A settlement agent completes a title search to ensure there are no claims or liens on your home. -

Maryland Recording Fees

The city or county charges a recording fee to legally record the property's deed and mortgage information. The seller can expect to pay around $2,066 in Anne Arundel County in recording fees, although they might be able to negotiate for the buyer to cover this cost. -

Attorney Fees

Hiring a real estate attorney for closing is optional in Maryland. On average, the hourly rate for an attorney is $242. Some real estate attorneys may offer a flat fee for closing services, which can range between $750 and $1,250 for straightforward closings.

Conclusion

Buying a home in Anne Arundel County, Maryland, is a significant financial commitment. By planning for the costs beyond the list price, such as the closing costs, you can ensure a successful real estate transaction.

Working with a knowledgeable and reliable real estate agent can make the home-buying process smoother. Give me a call today at 443-360-7111 or send me an email at jeaniehalloran@gmail.com to schedule an appointment.

Frequently Asked Questions

-

Who usually pays transfer taxes in Anne Arundel County, MD?

In Anne Arundel County, both the buyer and the seller are responsible for transfer taxes. Typically, the buyer and the seller split these costs, which are negotiated as part of the sales agreement. -

How much are property transfer taxes in Anne Arundel County?

Property transfer taxes are set at 1% for transactions under $1 million, and 1.5% for those at $1 million or more. -

What is the average percentage of closing costs in Maryland?

Buyers are expected to pay around 2% to 5% of the home’s purchase price, while the closing costs for sellers is approximately 8% to 10% of the home’s agreement value.